2026 Berkeley Spring Forum on M&A and the Boardroom

Conference Schedule

Agenda

(All times Pacific)

Registration

Welcome Remarks

Adam Badawi, Professor University of California, Berkeley School of Law

Ethan Klingsberg, Co-Head of US Corporate/M&A Freshfields

Angeli Patel, Executive Director Berkeley Center for Law and Business

The Roles of M&A and Antitrust in the Tech Sector with Cory Doctorow

Cory Doctorow author of the best-selling critique of M&A and Antitrust in the Tech Sector, Enshittification: Why Everything Suddenly Got Worse and What to Do About It

Fireside Chat with Cory Doctorow

Cory Doctorow author of the best-selling critique of M&A and Antitrust in the Tech Sector, Enshittification: Why Everything Suddenly Got Worse and What to Do About It

Moderated by:

Frank Partnoy, Professor University of California, Berkeley School of Law

Break

DExit and Other State Corporate Law Developments

John DiTomo, Partner Morris Nichols Arsht & Tunnell

Paul Grewal, Chief Legal Officer Coinbase

Jai Ramaswamy, Chief Legal Officer Andreessen Horowitz

Honorable Lori W. Will, Vice Chancellor Delaware Court of Chancery

Moderated by:

Ethan Klingsberg, Co-Head of US Corporate/M&A Freshfields

Break

Address by Daniele Calisti

Daniele Calisti, Head of Merger Support & Policy European Commission

The European Commission’s Approach to Tech M&A

Daniele Calisti, Head of Merger Support & Policy European Commission

Moderated by:

Jenn Mellott, Partner Freshfields

Burgeoning Role of State Attorneys General in US Antitrust Enforcement and Review of Mergers

Ellen Rosenblum, Oregon State AG (2012-24), Senior Counsel Freshfields

Christine Wilson, FTC Commissioner (2018-2023), Head of US Antitrust Practice Freshfields

Break

How to Evaluate AI Companies

Claire Hart, Chief Operating Officer and Chief Legal Officer Groq

Sue Meng, Managing Director Duquesne Family Office (Stanley Druckenmiller)

Jennifer Miller, General Counsel Superhuman (formerly known as Grammarly)

Moderated by:

Anna Gressel, Global Co-Head of AI Practice Freshfields

Fireside Chat with SEC Corp Fin Director James J Moloney

James J. Moloney, Director of the Division of Corporation Finance U.S. Securities and Exchange Commission

Moderated by:

Sarah Solum, Global Co-Head of Capital Markets and US Managing Partner Freshfields

Fireside Chat with Delaware Supreme Court Justice Valihura

Honorable Karen L. Valihura, Justice Supreme Court of Delaware

Moderated by:

Adam Badawi, Professor University of California, Berkeley School of Law

Mary Eaton, Co-Head of US Securities & Shareholder Litigation Freshfields

Speakers

Adam Badawi

Professor

University of California, Berkeley School of Law

Adam Badawi is a Professor of Law at UC Berkeley. He writes widely on issues of law and finance with an emphasis on corporate governance, corporate transactions, and shareholder litigation. Much of his recent work uses text analysis and machine learning to analyze debt agreements, merger documents, and shareholder class action complaints. At Berkeley Law, he teaches Contracts, Corporations, Mergers and Acquisitions, and seminars related to these topics.

His research includes Does Voluntary Financial Disclosure Matter? The Case of Fairness Opinions in M&A (forthcoming, The Journal of Law and Economics) (co-authored with Matthew D. Cain and Steven Davidoff Solomon), How Informative is the Text of Securities Complaints? (forthcoming, Journal of Law, Economics & Organization), Social Good and Litigation Risk (forthcoming, Harvard Business Law Review) (co-authored with Frank Partnoy); and Is There a First-Drafter Advantage in M&A?, California Law Review (2019, California Law Review) (co-authored with Elisabeth de Fontenay) (selected as one of the top 10 corporate and securities articles of 2019 by Corporate Practice Commentator).

Prior to joining the faculty of Berkeley Law in 2017, Badawi was a Professor of Law at Washington University in St. Louis. He has been a Visiting Professor at Northwestern Pritzker School of Law and he served as a Bigelow Fellow at the University of Chicago Law School. Before joining the academy he was a litigator in the San Francisco office of Munger, Tolles & Olson LLP and was a law clerk to the Hon. Michael McConnell of the Tenth Circuit Court of Appeals.

Daniele Calisti

Head of Merger Support & Policy

European Commission

Daniele Calisti

Head of Merger Support & Policy

European Commission

John DiTomo

Partner

Morris Nichols Arsht & Tunnell

John is a trial lawyer with two decades of experience representing boards of directors, investors, and Fortune 500 companies in cases involving corporate governance issues, mergers and acquisitions, and stockholders’ rights.

John’s practice puts him at the forefront of the major M&A cases litigated in the Delaware Court of Chancery and the Delaware Supreme Court. He also has significant experience litigating cases in the Complex Commercial Litigation Division (CCLD) of the Delaware Superior Court.

John leverages his deep knowledge of Delaware law and finance to craft solutions for his clients. He brings impressive experience on high-profile cases, including, Politan v. Masimo, West Palm Beach Firefighters’ Pension Fund v. Moelis & Company, and In re Match Group, Inc. Stockholder Litigation that involved consequential developments in Delaware law. Some of John’s recent trial victories include a case involving board control and an activist investor, and a first-of-its-kind case in the venture capital space.

Outside of the courtroom, John serves on the Delaware Court of Chancery Rules Committee and the Board of Trustees of the University of Pennsylvania Institute for Law and Economics. He has been recognized in the peer-reviewed law firm ranking publication Chambers USA as a leading Delaware Chancery practitioner, mentioned in The Legal 500 US for his M&A litigation defense work, and listed among Lawdragon’s 500 Leading Litigators in America.

John is a graduate of the University of Pennsylvania Law School where he served as an editor of the Journal of Constitutional Law and earned a Certificate of Study in Business Economics and Public Policy from the Wharton School of the University of Pennsylvania. Following law school, he clerked for the former Chancellor of the Delaware Court of Chancery, the Honorable William B. Chandler, III.

Cory Doctorow

author of the best-selling critique of M&A and Antitrust in the Tech Sector, Enshittification: Why Everything Suddenly Got Worse and What to Do About It

Cory Doctorow (craphound.com) is a science fiction novelist, journalist and technology activist. He is a contributor to many magazines, websites and newspapers. He is a special advisor to the Electronic Frontier Foundation (eff.org), a non-profit civil liberties group that defends freedom in technology law, policy, standards and treaties. He holds an honourary doctorate in laws from York University (Canada) and an honorary doctorate in computer science from the Open University (UK), where he is a Visiting Professor; he is also a Cornell University AD White professor-at-large, a MIT Media Lab Research Affiliate and a Visiting Professor of Practice at the University of North Carolina’s School of Library and Information Science. In 2024, the Media Ecology Association awarded him the Neil Postman Award for Career Achievement in Public Intellectual Activity. In 2022, he earned the Sir Arthur Clarke Imagination in Service to Society Awardee for lifetime achievement. In 2020, he was inducted into the Canadian Science Fiction and Fantasy Hall of Fame. In 2007, he served as the Fulbright Chair at the Annenberg Center for Public Diplomacy at the University of Southern California.

His novels have been translated into dozens of languages and are published by Tor Books (US), Head of Zeus (UK), Verso Books (UK), Beacon Press (US), SCRIBe (UK), Titan Books (UK) and HarperCollins (UK). He has won the Locus, Prometheus, Copper Cylinder, White Pine and Sunburst Awards, and been nominated for the Hugo, Nebula and British Science Fiction Awards.

He is the author of dozens of books, most recently ENSHITTIFICATION: WHY EVERYTHING SUDDENLY GOT WORSE AND WHAT TO DO ABOUT IT (nonfiction); and the novels PICKS AND SHOVELS and THE BEZZLE (followups to RED TEAM BLUES). Other notable books include the solarpunk novels WALKAWAY and THE LOST CAUSE; the tech policy books THE INTERNET CON and CHOKEPOINT CAPITALISM; and the internationally bestselling YA LITTLE BROTHER series; and the picture book POESY THE MONSTER SLAYER.

He maintains a daily blog at Pluralistic.net.

Mary Eaton

Co-Head of US Securities & Shareholder Litigation

Freshfields

Mary Eaton has extensive experience in shareholder litigation and M&A disputes, with a focus on securities class actions, stockholder derivative claims, contested books and records demands, pre- and post-deal challenges, and other complex business disputes. Mary regularly represents issuers, boards of directors, board committees and senior management across a broad spectrum of industries in a wide variety of disputes in federal and state courts across the country. In addition to her substantial trial experience, Mary regularly counsels clients on litigation avoidance and corporate governance matters.

Among her many accolades, Mary is ranked among leading litigators by Chambers USA for securities litigation, and is recognized by Benchmark Litigation as a “Litigation Star’ and ‘National Practice Star’ and in its ‘Top 250 Women in Litigation’, Lawdragon as one of its top 500 litigators in America, Crain’s New York Business as a ‘Notable Woman in Law’, and the Legal 500 as a ‘Leading Partner’. She is a recognized thought leader, writing and speaking about securities laws issues in multiple outlets and at various conferences and events.

In recognition of her public service, Mary has also won multiple awards for her work, including from the American Bar Association, the Federal Bar Council, the Legal Aid Society, and the New York State Bar Association. She also is a member of the Board of Directors of the Legal Aid Society, the Board of Directors of the New York City Bar Fund, and the Board of Editors of the New York Law Journal.

Stavros Gadinis

Professor

University of California, Berkeley School of Law

Professor Gadinis’ research examines questions in corporate law and financial regulation, both domestic and international. He is particularly interested in the interplay between companies and regulators, exploring the institutional framework for law enforcement, compliance, and risk management. In the last few years, he has focused on sustainability and social issues as an attempt to expand the scope of corporate governance. In Corporate Law and Social Risk (co- authored with Amelia Miazad) (2020 Vanderbilt Law Review), the focus is on stakeholder outreach as a governance system seeking to identify and address social risks for the business. In a follow-up article, A Test of Stakeholder Capitalism (co-authored with Amelia Miazad), they explore how corporations relied on feedback from stakeholders to address the implications of the Covid pandemic. His article The Hidden Power of Compliance (co-authored with Amelia Miazad) (2019 Minnesota Law Review) explores how extensive internal reporting within companies impacts the liability of board members. In Collaborative Gatekeepers (co-authored with Colby Mangels) (2016 Washington & Lee Law Review) he explores anti-money laundering law as a model of pro-active misconduct reporting. Gadinis’ work has also traced the spread of financial standards around the world, showing how private, regulator, or government supports leads to distinct results (Three Pathways to Global Standards, 2015 American Journal of International Law). Gadinis has argued that systemic risk reforms introduced after the 2008 financial crisis has resulted in increasing the role of political appointees over independent regulators in the oversight of the financial system (2012 California Law Review).

Before entering into academia, Gadinis practiced corporate law for four years in Europe. Gadinis completed his S.J.D. at Harvard in May 2010. He also holds an LL.M. degree from the University of Cambridge (UK), and a law degree from Aristotle University, Greece.

Anna Gressel

Global Co-Head of AI Practice

Freshfields

Anna Gressel is a leading legal advisor to boards and senior legal executives on artificial intelligence, known for guiding global businesses through complex, high-impact matters at the intersection of technology, regulation, and litigation. Anna’s cross-functional practice focuses on counseling companies on AI legal, regulatory, and reputational considerations, including with respect to safety, liability, intellectual property, and consumer protection. Anna translates her technical fluency around emerging technologies into practical guidance that helps clients anticipate product-specific risks before they reach the market. She is also known among her clients for building trusted relationships with in-house legal, policy, and technical teams — aligning product design with legal defensibility and long-term strategic goals.

Anna represents companies in internal investigations, regulatory inquiries, and litigations concerning AI and other cutting-edge technologies. She also regularly helps corporations to benchmark and mature their AI governance and regulatory structures, particularly as advances in agentic AI and other technologies continue to pose novel legal challenges. Anna’s clients span sectors and include major technology developers, online platforms, asset managers, financial services, and life sciences and pharmaceutical companies.

Anna was named one of the “Top 100+ Women Leading AI in 2023” by Re-Work— one of only three lawyers in private practice to receive this honor. She is ranked Band 3 in Chambers USA’s inaugural nationwide Artificial Intelligence 2025 ranking and is recognized by Chambers Global in the Spotlight as a “Global Market Leader” in artificial intelligence. Her clients describe her as “an absolute rockstar, she is my go-to for complex AI matters”.

Anna holds a senior prize in neuroscience from Pomona College, was a Fulbright research fellow in Morocco, and is a fellow of the American Bar Foundation.

Paul Grewal

Chief Legal Officer

Coinbase

Paul Grewal is the Chief Legal Officer of Coinbase Global, Inc., where he is responsible for Coinbase’s legal, compliance, global intelligence and government relations groups. Before joining Coinbase, Paul was Vice President and Deputy General Counsel at Facebook and served as United States Magistrate Judge for the United States District Court for the Northern District of California. Paul was previously a partner at Howrey LLP. He received his JD from the University of Chicago Law School and his SB from MIT.

Claire Hart

Chief Operating Officer and Chief Legal Officer

Groq

Claire Hart is Chief Operating Officer, Chief Legal Officer, and a board member at Groq Inc., where she advises and operates at the intersection of AI, semiconductors, and global technology strategy. She brings deep expertise in legal, business, and operational leadership to help high-growth technology platforms scale responsibly and strategically across global markets.

As COO and CLO, Claire leads Groq’s Legal, IP licensing, government relations, communications, IT, and engineering functions. In this capacity, she partners closely with the board, investors, and executive team on governance, corporate strategy, risk and compliance frameworks, and enterprise execution as Groq expands its footprint in the AI and semiconductor ecosystem. Claire played a central role in spearheading Groq’s landmark non-exclusive inference technology licensing agreement with Nvidia aimed at accelerating high-performance AI inference at global scale, a strategic collaboration that underscores Groq’s industry impact and broad technology relevance.

Prior to her current role, Claire was General Counsel and Head of People and Business Affairs at Genies, where she oversaw legal, HR, IT, business affairs, and internal operations through the company’s Series C financing, governance evolution, and strategic partnerships across gaming, entertainment, and technology. She also served as Chief Legal Officer of Blizzard Entertainment, leading legal and transactional matters for one of the world’s largest digital entertainment businesses. Earlier in her career, Claire held senior legal leadership roles at Google supporting YouTube, Google Play, Next Billion Users, and Jigsaw, and began her legal career in private practice at Weil, Gotshal & Manges.

Claire is an active board member and advisor to nonprofit and academic institutions, including Northwestern University Pritzker School of Law. A frequent speaker on AI, technology law, governance, and leadership.

Ethan Klingsberg

Co-Head of US Corporate/M&A

Freshfields

Ethan Klingsberg, as co-head of Freshfields’ US Corporate and M&A group, has a practice that focuses on boards of directors, corporate law, M&A and SEC matters. He leads a spectrum of strategic projects for clients in the Bay Area, many of whom have been working continuously with Ethan for over two decades. Indeed, he co-founded the Berkeley Law Spring Forum on M&A and the Boardroom eleven years ago, and continues to curate this event, to ensure these clients receive the most up to date insights and value-additive information available. Ranked Band 1 for Corporate/M&A by both Chambers USA and Chambers Global, Ethan has received the Burton Award for Legal Achievement for writing on fiduciary duties, was named a “top 10 innovative lawyer” for North America by the Financial Times, has been elected by peers at other firms to be a Fellow of the American College of Governance Counsel, and named a “BTI Client Service All-Star” based on the survey of general counsels of the Fortune 1000, a Law360 M&A “MVP,” a “Legend” by Lawdragon, and “Dealmaker of the Year” by the American Lawyer. A regular guest on BloombergTV and CNBC to discuss M&A, governance, shareholder activism, the SEC, and board processes, his essays on corporate law topics have appeared in The Financial Times, Reuters Breaking Views, MarketWatch, The New York Law Journal, and the Harvard Law School Forum on Corporate Governance. He is grateful to the amazing teams at Berkeley and Freshfields that make this event a stand-out.

Jenn Mellott

Partner

Freshfields

Jenn Mellott is a Partner at Freshfields LLP. She is jointly based in the firm’s Washington DC and Brussels offices, and is a Chambers ranked advisor to clients on multi-national transactions and other competition matters. Jenn’s dual location makes her exceptionally well placed to advise on a range of US, EU and international antitrust law issues. She advises on all aspects of US and EU competition law, including merger control, antitrust compliance counselling, antitrust litigation and behavioral investigations. She has extensive experience representing clients in complex Second Request and Phase II merger control proceedings and cartel investigations in the US, EU, and UK. Jenn has experience advising clients in various industry sectors, including pharmaceutical and life sciences, telecommunications, technology, industrials, and financial institutions. Jenn joined Freshfields in Washington in 2012. She was resident in Freshfields’ Hong Kong office in the second half of 2012 and has been jointly based on Washington and Brussels since 2018. Jenn was shortlisted by Global Competition Review as Dealmaker of the Year in 2026, has been included on Who’s Who Legal’s list of leading competition lawyers since 2022 and Lawdragon’s 500 Leading Lawyers in America and 500 Leading Global Antitrust & Competition Lawyers guides in 2026. Jenn has authored articles on various antitrust and competition topics for Concurrences, the Antitrust Bulletin, and the ABA Antitrust Magazine. She also developed and hosts Freshfields’ Competition podcast, Essential Antitrust

Sue Meng

Managing Director

Duquesne Family Office (Stanley Druckenmiller)

Sue Meng is Partner and Managing Director of Duquesne Family Office, LLC, the investment firm of Stanley Druckenmiller. She leads the firm’s private investment strategy, which focuses on backing disruptive, high-growth technology and life sciences companies globally. Ms. Meng also serves as General Counsel to Mr. Druckenmiller.

Ms. Meng serves on the boards of Ledgebrook, an insuretech company, and Soley Therapeutics, a drug discovery company, alongside fellow investors and board members Doug Leone and Jim Breyer. She is also on the advisory board of Q.ANT, a German photonic chip company.

Ms. Meng is President of the Board of Trustees of The Brearley School and formerly chaired its Audit Committee. Ms. Meng also serves as executive vice president and secretary of the Board of Trustees of Prep for Prep. As a former Rhodes and Soros scholar, Ms. Meng has previously served on the national selection committees for the Rhodes, Soros and Schwarzman scholarships.

Previously, Ms. Meng was a corporate partner at Debevoise & Plimpton LLP. In her practice at Debevoise, Ms. Meng advised public companies, boards of directors and special committees on mergers and acquisitions, strategic investments and other significant matters.

Ms. Meng was selected as Dealmaker of the Year by The American Lawyer (2022) for her representation of Discovery in its $130 billion acquisition of Warner Media from AT&T, one of the largest deals in the world in 2021. She was also selected as Dealmaker of the Year by The American Lawyer (2020) for her

representation of Toyota Motor Corporation in its $1 billion joint investment, alongside Softbank, in Uber’s Advanced Technologies Group.

While at Debevoise, Ms. Meng was ranked as a leading M&A lawyer by Chambers USA on its “Corporate M&A: The Elite” list.

Ms. Meng received an A.B., magna cum laude, with highest honors in History and Literature from Harvard University. She received a M.St. with distinction in English Literature and a M.Phil. with distinction in Modern Chinese Studies from Oxford University, which she attended as a Rhodes Scholar. She received a J.D. from Yale Law School. She is fluent in Mandarin Chinese.

Jennifer Miller

General Counsel

Superhuman (formerly known as Grammarly)

Jennifer Miller serves as General Counsel at Superhuman (formerly Grammarly), the AI productivity platform on a mission to unlock the superhuman potential in everyone. The company’s products include Grammarly’s writing assistance, Coda’s collaborative workspaces, Mail’s inbox management, and Go, the proactive AI assistant that understands context and delivers help automatically. Jennifer recently led the company through its acquisitions of Coda and Superhuman Mail. Before Superhuman, she served as Chief Legal Officer at Starship Technologies, and before that, she was General Counsel and Head of Regulatory and Government Affairs at Loon, the Alphabet Moonshot Company. Jennifer is an active community volunteer, nonprofit board member, and regular public speaker. Jennifer is regularly recognized by her peers for her achievements, most recently in April 2025 as a Top 50 Corporate Counsel by OnConferences. Jennifer is a graduate of Georgetown University Law Center and Mount Holyoke College.

James J. Moloney

Director of the Division of Corporation Finance

U.S. Securities and Exchange Commission

James J. Moloney became the Director of the Division of Corporation Finance at the SEC in October 2025.

Jim previously served at the SEC for six years prior to joining Gibson Dunn & Crutcher, where he worked for 25 years, ascending from corporate associate to equity partner. He served as a longstanding Co-Chair of the firm’s Securities Regulation and Corporate Governance Practice. He advised a wide base of clients on corporate governance matters, disclosure rules, mergers & acquisitions, tender offers, proxy contests, and going-private transactions among other areas.

During his tenure at the SEC from 1994 to 2000, Jim was an attorney-advisor and later a Special Counsel in the Office of Mergers & Acquisitions in the Division of Corporation Finance. Notably, Jim was the primary author of the proposing and adopting releases for Regulation M-A, a comprehensive set of rules governing mergers & acquisitions, tender offers and proxy solicitations.

Jim received his LL.M. degree in securities regulation with distinction from the Georgetown University Law Center. He received his J.D. degree cum laude from Pepperdine University, where he was an editor of the Pepperdine Law Review. He received his B.S. degree in business administration from Boston University.

Frank Partnoy

Professor

University of California, Berkeley School of Law

Professor of Law, University of California, Berkeley Frank Partnoy is the Adrian A. Kragen Professor Law at the UC Berkeley School of Law and Affiliated Faculty at the Berkeley Haas School of Business and the Simons Institute for the Theory of Computing. He has written several books, dozens of scholarly articles, and more than fifty opinion pieces in The New York Times and the Financial Times. Partnoy has appeared on 60 Minutes and The Daily Show with Jon Stewart, and has testified before both houses of Congress. He has been an international research fellow at Oxford since 2010, and is a graduate of Yale Law School.

Angeli Patel

Executive Director

Berkeley Center for Law and Business

Angeli Patel is the Executive Director of the Berkeley Center for Law and Business, where she focuses on advancing corporate strategy, governance, and innovation in a rapidly evolving global landscape. She is deeply engaged in UC Berkeley’s innovation ecosystem, serving on the Innovation & Entrepreneurship Council and the Advisory Board of the Open Innovation Squad at Berkeley Haas School of Business.

As a practicing attorney, Angeli advises on AI and sustainability governance and corporate strategy. She began her legal career at Jones Day in the M&A practice and later joined the Sustainability & ESG Advisory Practice at Paul, Weiss, Rifkind, Wharton & Garrison LLP, advising clients on governance strategies to address climate and social risks.

Prior to her legal career, Angeli advised global governments and NGOs, including White House Office of Management and Budget under the Obama Administration focusing on government digitization and management reform; a policy advisor at the U.S. Department of Health and Human Services, addressing consumer privacy. She also advised the UN Global Compact Network Australia on anti-corruption and business & human rights; as well as at the Government of Chile, Ministry of Finance on the country’s first government modernization initiatives.

As startup advisor and entrepreneur herself, Angeli is passionate about scaling businesses that align growth with social & political ecosystems. She launched an e-commerce business for women of color in 2021 and advises the Leadership & Development startup, Mandala.

Angeli holds a JD from Berkeley Law.

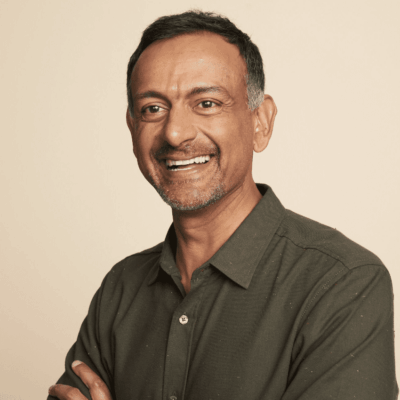

Jai Ramaswamy

Chief Legal Officer

Andreessen Horowitz

Jai currently oversees the legal, compliance, and government affairs functions at Andreessen Horowitz as Chief Legal and Policy Officer. He was previously the Chief Risk & Compliance Officer at cLabs, working on Celo, a mobile-first platform that makes financial dApps and crypto payments accessible to anyone with a mobile phone. Jai also spent several years in the financial services industry as the Head of Enterprise Risk Management at Capital One and the Global Head of AML Compliance Risk Management at Bank of America/Merrill Lynch. Before joining the private sector, he served for over a decade at the Justice Department, as a white collar crime prosecutor in the Southern District of New York, at headquarters in the Computer Crime and Intellectual Property Section, and later as Chief of the Asset Forfeiture and Money Laundering Section — a role in which he oversaw the prosecutions of BNP Paribas and HSBC for Bank Secrecy Act, Patriot Act and sanctions violations. Jai has an undergraduate degree in government and economics from Harvard University, a law degree from the University of Pennsylvania Law School and a doctorate in social and political science from Cambridge University, U.K.

Ellen Rosenblum

Oregon State AG (2012-24), Senior Counsel

Freshfields

Ellen Rosenblum is a leading advisor on state attorneys general enforcement and regulatory strategy, known for her deep experience navigating complex, high-stakes investigations and multi-state actions. As the former Oregon Attorney General and past president of the National Association of Attorneys General (NAAG), Ellen brings unparalleled insight into state AG priorities, investigative strategies, and enforcement trends. Her cross-functional practice focuses on counseling companies facing state-level scrutiny across consumer protection, data privacy, antitrust, financial regulation, and environmental enforcement. Ellen translates her deep relationships with state AGs nationwide—built through decades of bipartisan collaboration—into practical guidance that helps clients anticipate enforcement actions before they escalate and navigate multi-state coordination with strategic precision.

Ellen was chosen by her peers to serve as President of NAAG in 2024 and received NAAG’s Kelley/Wyman Award for Attorney General of the Year. During her 12+ years as Oregon’s Attorney General, she led hundreds of successful state and national policy initiatives, investigations, and lawsuits that resulted in record-breaking financial settlements and shaped policies to safeguard consumers nationwide. She was the first woman elected state attorney general in Oregon’s history. Her clients value her ability to translate insider knowledge of state AG offices into actionable strategies that align compliance with business objectives.

Ellen served as an Assistant United States Attorney for the District of Oregon, where she prosecuted economic crimes and built expertise in federal investigations. She also served as a judge on the Oregon Court of Appeals and on the Multnomah County District and Circuit Courts. Ellen has served as Secretary of the American Bar Association, Chair of the Section of State, Local and Tribal Government Law, and is a member of the American Law Institute and a past chair of the Fellows of the American Bar Foundation.

Sarah Solum

Global Co-Head of Capital Markets and US Managing Partner

Freshfields

Sarah Solum is US Managing Partner and Global Co-Head of Capital Markets at Freshfields, based in Silicon Valley. She works with public companies on corporate and transactional matters. She has extensive experience in equity and debt capital markets transactions, has an active IPO practice and is ranked Band 1 nationwide by Chambers USA for debt and equity offerings. Sarah works closely with Boards and management teams on corporate governance, SEC disclosure and compliance matters, as well as other strategic and sensitive issues affecting public companies. Among other things, Sarah is experienced in advising on dual class stock structures and issues that are unique to founder-led companies, as well as anti-takeover measures.

Sarah received her JD, magna cum laude, and her LL.M from Duke University School of Law. She received her BA, summa cum laude, from St. Olaf College. Sarah is admitted to practice in the State of California and the State of New York.

Honorable Karen L. Valihura

Justice

Supreme Court of Delaware

The Honorable Karen Valihura was sworn in as Justice of the Supreme Court of Delaware on Friday, July 25, 2014.

Justice Valihura, as a practicing lawyer, was consistently selected for inclusion in Chambers USA: America’s Leading Lawyers for Business and The Best Lawyers in America. Her corporate litigation practice included complex commercial and corporate governance issues, federal and state securities matters, as well as mergers and acquisitions and other transactional litigation. Prior to her appointment to the Supreme Court, Justice Valihura was a partner at Skadden, Arps, Slate, Meagher & Flom, LLP, where she practiced law from 1989 until her appointment to the Court in 2014.

Justice Valihura served on the Advisory Board of the John L. Weinberg Center for Corporate Governance and served as Chair of the Delaware Supreme Court’s Board on Professional Responsibility and as Chair of the Delaware Supreme Court’s Permanent Ethics Advisory Committee on the Delaware Rules for Professional Conduct. Justice Valihura served for eight years on the Corporation Law Council of the Corporation Law Section of the Delaware State Bar Association. Additionally, Justice Valihura served her community as a member of the Board of Directors for the Delaware Special Olympics for eighteen years, including service as that Board’s President, and as a member of the Delaware Bar Foundation for eight years, including service as that Board’s President.

As a Justice, she was selected by the National Association of Corporate Directors to the NACD Directorship 100, honoring the most influential people in corporate governance. She is also a member of the American Law Institute, including its Board of Advisors for its Restatement of Corporate Governance. She served as Co-Chair to the Delaware Supreme Court’s Access to Justice Commission and currently serves as Co-Chair of its Law and Technology Commission.

Justice Valihura received her undergraduate degree from Washington and Jefferson College in 1985 where she was valedictorian, and her law degree from the University of Pennsylvania Law School where she was a member of the Law Review. She served as a law clerk to Judge Robert E. Cowen of the U.S. Court of Appeals for the Third Circuit.

Honorable Lori W. Will

Vice Chancellor

Delaware Court of Chancery

The Honorable Lori W. Will was sworn in as a Vice Chancellor of the Court of Chancery in May 2021.

She was previously a partner at Wilson Sonsini Goodrich & Rosati, P.C. and a senior associate at Skadden, Arps, Slate, Meagher & Flom LLP. She served as a law clerk to then-Vice Chancellor Leo E. Strine, Jr.

Vice Chancellor Will received her B.A. summa cum laude in both History and Government & Law from Lafayette College, her J.D. from the University of Pennsylvania Law School, and a graduate Certificate in Business and Public Policy from the Wharton School. She is a member of the American Law Institute and the American Bar Association.

Vice Chancellor Will is an Adjunct Professor of Law at NYU School of Law and at the University of Pennsylvania Law School. She is also a Lecturer at the University of Chicago Law School and a Visiting Professor at the The University of California, Berkeley, School of Law.

Christine Wilson

FTC Commissioner (2018-2023), Head of US Antitrust Practice

Freshfields

Christine leads Freshfields’ US antitrust, competition, and trade practice, and is based in our Washington, DC office. Drawing on 30 years of public and private sector experience at the intersection of law, policy, and politics, Christine counsels clients on how to navigate complex and evolving legal and regulatory regimes to achieve their desired business goals.

Most recently, Christine served as a Commissioner at the FTC, where she helped shape policies and enforcement actions in the fields of antitrust, consumer privacy & data security, and consumer protection. Before joining the Commission, Christine was a Senior Vice President at Delta Air Lines, where she oversaw regulatory and international matters. She also was an antitrust partner at two major international law firms.